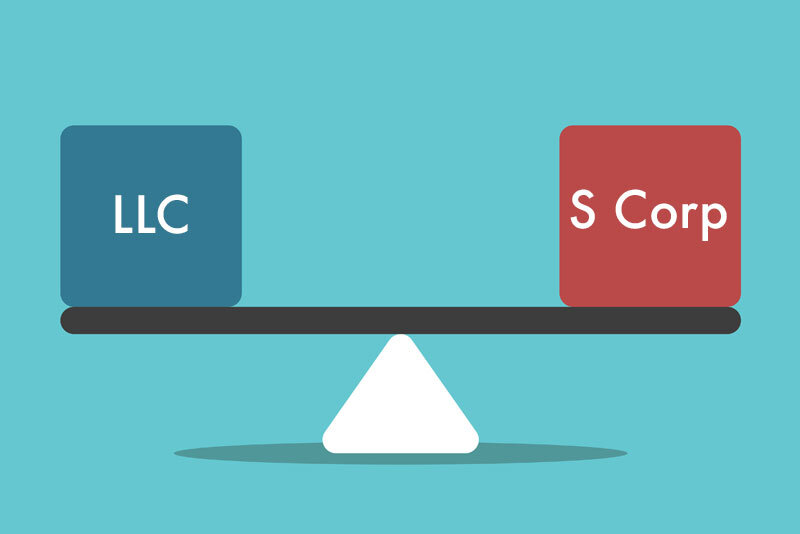

DBA vs. LLC: What’s the Difference?

If you’re starting a new business or adding new locations or business lines to an existing one, you are likely wondering if registering a DBA (doing business as) or forming an LLC (limited liability company) is the best route to travel. A DBA is an assumed...